The Impact of California’s QSR Minimum Wage Law: Insights from Real Data

After months of debate and anticipation, California’s minimum wage law for fast food workers, signed into law in September 2023, officially took effect in April 2024. This significant policy change, which raised the minimum wage for fast food workers to $20 per hour, sparked widespread concern about its potential impact on the state’s Quick Service Restaurant (QSR) industry. With predictions of a wave of closures as restaurants struggled to manage the increased labor costs, the question on everyone’s mind was: what has actually happened since the law came into force?

By analyzing our Point-of-Interest (POI) data, we’ve uncovered a nuanced picture of the situation. Our findings not only shed light on the impact of the wage increase but also reveal the broader economic forces influencing the industry.

Initial Impact: September 2023

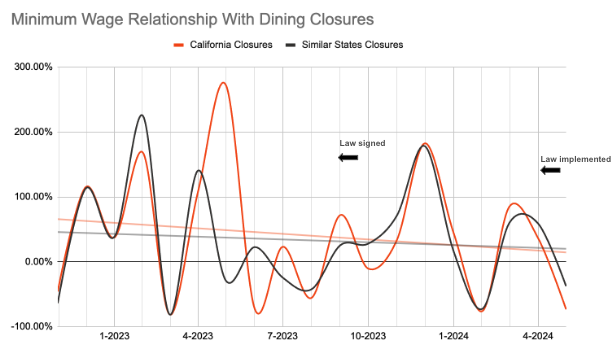

When the QSR minimum wage law was signed in September 2023, the data showed a notable decrease in dining POIs in California— nearly three times greater than what was observed in comparable states. Specifically, the monthly percent change of dining closures in California in September 2023 was 71%, while similar states experienced only a 25% increase in closures. This sharp decline immediately raised concerns, suggesting that the new law might be having a swift and adverse effect on the industry.

However, it’s essential to place this data in context. Fluctuations in closure rates were already occurring before September, pointing to other underlying factors influencing the QSR landscape in California. For example, in May 2023, we observed significant variations in closure rates, which may have been driven by broader economic pressures such as the Federal Reserve’s rapid rate hikes, negative net migration, and local economic challenges. These factors suggest that the QSR industry was already navigating a complex economic environment, making isolating the wage law’s impact challenging.

Post-Law Implementation: 2024 Trends

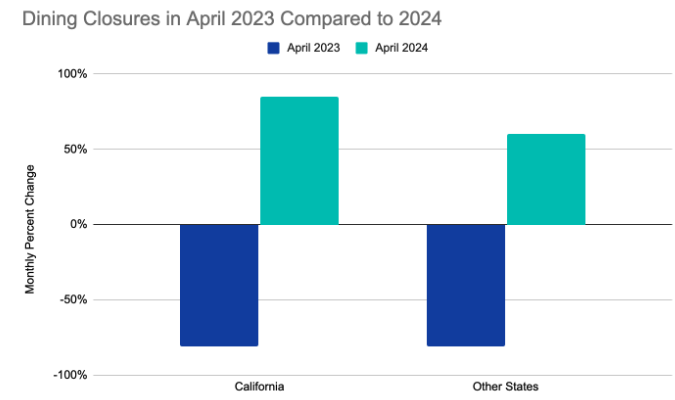

As the minimum wage law took full effect in April 2024, many expected another sharp increase in QSR closures. Indeed, our data confirms this expectation: closures in California surged by 80% from March 2024 to April 2024, a stark contrast to the same period in the previous year, where closures decreased by 80%. However, this trend was not isolated to California; comparable states across the country also experienced a rise in closures during this period. This parallel suggests that broader national economic conditions, rather than the wage law alone, played a significant role in driving these closures.

Looking beyond the immediate impact, the data reveals that by late 2024, closure rates in California have begun to align closely with those in peer states. This trend indicates that while the initial shock from the wage increase was real, it may have been absorbed or overshadowed by other factors over time. This alignment suggests that the wage law’s impact must be viewed within the larger context of national economic trends that have influenced the industry as a whole.

Broader Economic Context

National economic factors, such as rising inflation rates and shifts in labor market conditions, have likely compounded the challenges QSRs faced in California and nationwide. For instance, the monthly change in closures from January to March 2024 was 124%, compared to an 89% increase during the same period in 2023. These figures highlight the significant influence of broader economic pressures, which may have had a more substantial impact on closures than the wage law itself.

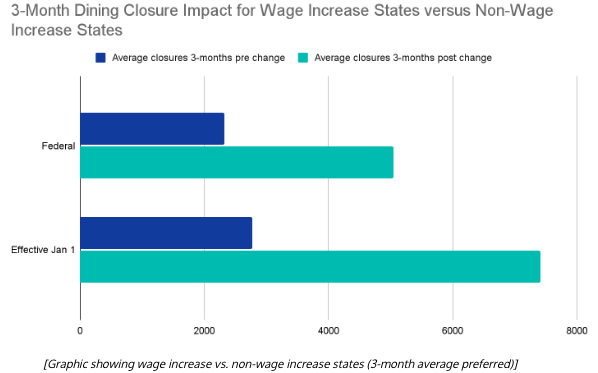

Our analysis also reveals similar trends in other states that did not implement a wage increase, reinforcing that the broader economic environment played a crucial role in shaping the outcomes we observed. When comparing data from wage-increase states to those without such changes, it becomes clear that macroeconomic forces likely had the most significant influence on closure rates across the board.

The data shows that while California’s QSR minimum wage law had an immediate impact on the industry, the broader economic environment played the most significant role in shaping the trends we observed. The patterns in California mirror those seen across the country, highlighting that macroeconomic factors were the primary drivers behind the changes in the QSR sector. Despite the initial shock of the wage increase, restaurant employment in California is only slightly worse than in comparable states over the entire year. This underscores the dominance of more significant economic trends in determining the industry’s trajectory.

Looking Ahead

As we continue to monitor the impact of wage policies on industries like QSRs, it will be crucial to consider these findings within the broader economic context. Future research should focus on analyzing the long-term effects of these policies, as well as the influence of technological changes and other factors that may shape the industry’s future.

Our data-driven analysis underscores the importance of understanding the complex interplay between policy changes and macroeconomic forces, providing critical insights for the QSR industry and policymakers as they navigate these challenges. Staying informed with up-to-date data will be key to making sound, strategic decisions.

Are you interested in learning more? Contact dataplor to connect with our data experts today.